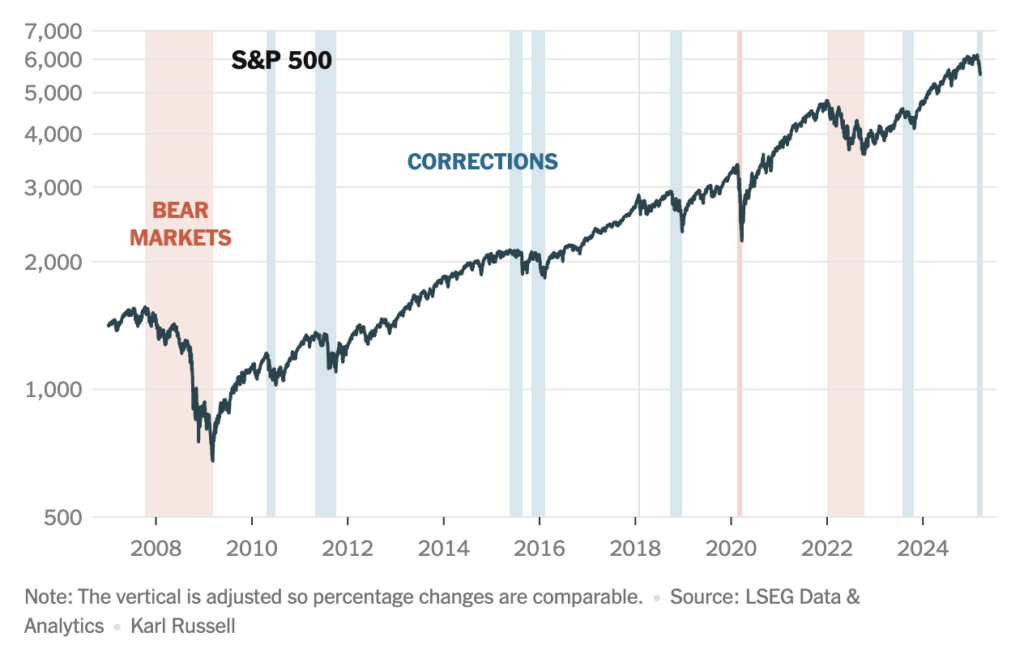

Last week, the S&P 500 declined to 10.1% below its high on February 19, pushing it into a correction – a term for when an index falls 10 percent or more from its most recent peak.

Further, President Trump and his advisors have stated in recent weeks that the short-term pain of a potential recession may be necessary for longer-term economic gains.

Regardless of whether you agree with the administration’s sentiment or policies, the recent correction and talk of a recession may feel unnerving. Maybe you’ve even wondered if now would be a good time to sell stocks.

Park Piedmont’s work with investors stretches back decades – which means we have lived through difficult times, for markets and the economy, and our American and global societies more broadly.

Although this particular moment in time may feel unique in its uncertainty, and although the past doesn’t necessarily inform the future, it’s helpful to remember that markets have historically recovered from periods of downward volatility.

In that spirit, we thought the advice we’ve given during other challenging periods might provide some helpful perspective. To quote Nobel laureate Paul Samuelson: “We have but one sample of history. Yet you must start with the past in order to understand the future.”

In January 2009, amid the depths of the Great Recession, we wrote:

It is highly appealing to think that you can simply exit the riskiest asset classes (i.e., stocks) when they are going down and return when they are going back up. Exiting is in fact the easy part. The difficult part is knowing when to get back in, because if you are out when the market begins to rebound, you miss much of the return from any recovery that occurs…

The current bear market (defined as down 20% from the recent peak), which started in October 2007, provides an excellent example of the difficulty of market timing. From the lows of late November 2008, the S&P 500 rose 25% through January 6, 2009. Someone who sold as the market was declining would have had to decide whether the rally from the November lows was the time to get back in. If they did, particularly late in that brief rally period, they would have been looking at significant additional declines by the end of January. And if they did stay on the sidelines, guessing right that time, when would they get back in, assuming they want to at least try to participate in the price gains that come with a recovery?

Please note that we don’t know when the recovery is coming any more than the next person, or that it is a given that a recovery is coming. Since it’s always uncertain whether or when the recovery is coming, we advocate maintaining some ongoing position in stocks and other risky assets, so as to be able to participate when and if the recovery does occur.

From our vantage point 16 years later, it’s clear that staying the course in 2009 would have meant participating in the substantial stock market gains in the years since. Yet we acknowledge it isn’t easy to focus on the long term in the middle of uncertainty and instability.

In June 2012, when the Dow lost all its gains for the year, we again advised to focus on the long-term and to trust your personalized asset allocation, providing life circumstances hadn’t changed:

At Park Piedmont, we advocate thinking about your investments in time frames relevant to you and your specific needs. Even people in retirement may need to use their money for twenty or more years, and many people have family and charitable goals that may make the relevant time frames even longer.

Given the apparent need for a long-term perspective, the tendency for people to react to day-to-day news events and daily market fluctuations presents an ongoing dilemma for investors and advisors. Adding to the uncertainty are periods like 2008 and early 2009, when the declines in many asset categories became extreme. Investors who should think long term began to distrust this advice, believing that the markets would not recover this time, and that even if they did, the entire activity of investing was tarnished beyond repair.

Even though there has been an approximate doubling of stock prices [in June 2012] from the 2009 lows, every period of decline since those lows (May-August 2010; May-September 2011; May 2012) has generated great anxiety among investors, fearing a repeat of 2008. And since no one can say with certainty that a repeat will not occur, there is a delicate balance to be struck between remaining in the riskier markets to pursue long-term gains, and moving to less risky, income-producing investments to preserve capital. This balance is what asset allocations are all about. We believe that each client’s personal allocation decision, once made (and accounting for any major changes in the client’s lives), should be maintained even when markets turn down.

In 2020, the S&P fell 34% from its February 19 high to its March 23 low. It was the S&P’s shortest-lived bear market, lasting just 33 days. By August 18, 2020, the index had reached a new high.

Most recently, the S&P bear market in 2022 lasted 282 days, beginning with its prior peak in December 2021, dropping 25% to its trough in September 2022, and recovering by March 2024.

To quote financial writer Nick Murray – and ourselves – from June 2012:

“For the long-term investor, and in an age of thirty year, two-person retirements, we are all long-term investors, basing an investment strategy on the apocalypse du jour has to be a losing strategy… Do markets go down in reaction to shocking world events? Almost invariably. But do they stay down? Well, although past performance is no guarantee of the future, not so far.”

We agree with Murray’s basic point, although we would immediately add that it is the asset allocation decision before the fact of the crisis that is the key to most people’s ability to withstand the declines when they do occur. A portfolio with 30% stocks provides a very different cushion to serious declines than a portfolio of 70% stocks. Each investor’s allocation needs to meet their ability to live with that portfolio during market declines.

As Murray says, selling after the declines has turned out to be the worst strategy, followed closely by the hope of getting out before the crisis… While there are many who criticize the long-term buy and hold strategy, we continue to be proponents, as long as the portfolio has an appropriate allocation to the risky parts of the markets, and the investments are mostly low-cost, diversified indexed mutual funds and exchange-traded funds (ETFs).

Our advice in 2009, and then again in 2012, remains the same in 2025: focus on your goals, think long-term (beyond the immediate and daily headlines), and trust your asset allocation. And if you’ve experienced any life changes that lead you to believe your asset allocation should change as well, please reach out to your advisor. We’re here to guide you through these uncertain times.